Table of Content

They can also be an option if you are a property investor looking for capital gains if you believe house price will rise. A repayment mortgage means your monthly payments are calculated so that what you pay includes some of the loan amount and the interest, meaning you are repaying the loan over the term. After the fixed period ends, your mortgage interest rate reverts to a floating rate - you can either keep at the floating rate or find a new fixed term.

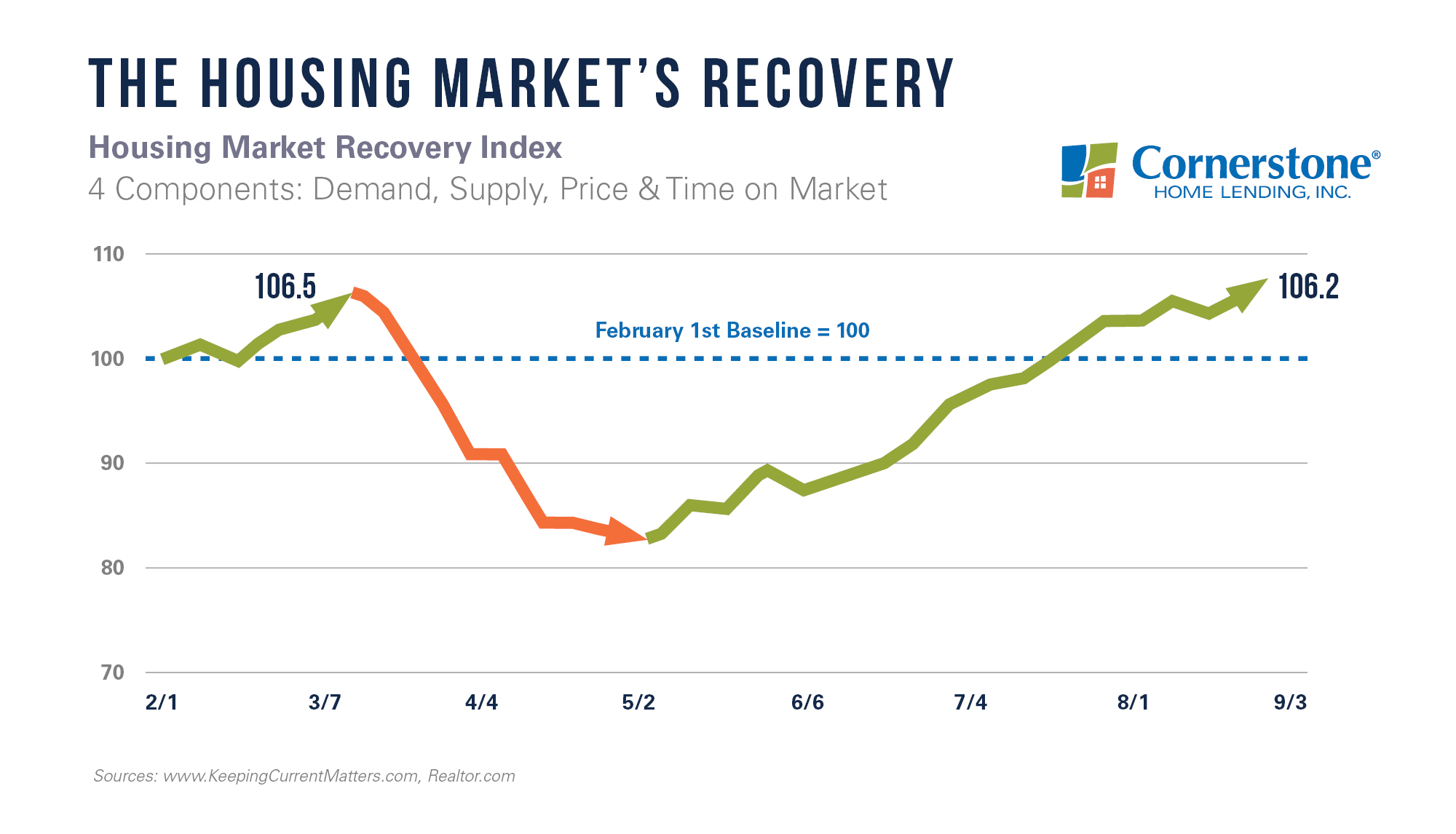

As you can imagine, interest rates are a hot topic in our newsletter . To keep up with the ever-changing landscape of interest rates, join our mailing list and receive updates in your inbox. Do we have any evidence in hand of the impact on the residential real estate market yet of the recent round of fixed... Get your mortgage right and it's the easiest money you'll make. Actual borrow amount may differ, depending on your full financial position. This report was written by Canstar’s Editor, Bruce Pitchers.

Where can I get a mortgage from?

Check out the interest rates below you might be pleasantly surprised. This is because the bank is incurring a loss by you breaking the term early. There are some instances where it’s worth breaking your fixed term, but it could also end up costing you more in the long run. Every situation is different so get in touch with one of the team to help you work out what’s best for you.

When looking for the best mortgage, you do need to look at more than just interest charges. It’s a feature that will enable you to withdraw your extra repayments from your mortgage and spend them if you need them. It’s helpful in financial emergencies but less flexible than an offset account. These days most mortgages allow extra repayments, although some fixed-rate mortgages do not. Some lenders charge an annual fee rather than an ongoing account-keeping fee on certain mortgages. Annual fees are usually charged when a loan is packaged with other banking products, such as a savings account and credit card.

Salvation Army Loans

We deal with more lenders than other brokers, giving you more options. Although I hadn't been particularly unhappy with my current power provider, when I purchased an EV I wanted to make sure I was not paying more for my power than necessary. Also, my current provider did not offer any 'Off Peak' plans to enable me to help myself to save money. Glimp saw my attempts to make comparisons myself and reached out. At first I was not happy with this, but Trina answered my questions thoughtfully and I expect to be switched today or tomorrow.

A fixed-rate home loan has an interest rate that is set for a certain amount of time – commonly 1, 2, 3, 4 or 5 years. As this is a tailored or specialist product you will pay a premium for it i.e. the floating rate will likely have a premium or margin added to it. A capped rate is a floating rate that is capped at a certain level i.e. you pay a floating rate but there is a limit, or cap at which your rates will stop rising. Their experience is unrivalled, and they will happily answer your questions about all things concerning the process of owning a home.

First Home Buyers: How to Buy a House with Less Than a 20% Deposit

Floating rate mortgages are more suitable for those who wish to pay off their loan as quickly as possible, as extra repayments allow you to make more headway with your loan principal. If you’re looking to buy an investment property, consider that investment loans typically have slightly higher rates than owner-occupier mortgages. Finding a great mortgage doesn’t have to be difficult, and Finder helps you compare mortgage rates from lenders.

Our helpful guides, calculators and resources are here for you to avoid ever paying more than you should. • It’s a good idea to choose a mortgage and get your finances in place before you start viewing properties so you can act quickly when the right property comes along. There are a wide range of different types of home loans available. Let us introduce you to an expert mortgage adviser for advice that offers you the most benefits. Our newsletter covers the latest market news including content from Tony Alexander, as well as tips for getting, managing and reviewing a mortgage. If economists are predicting a rise in interest rates, you can lock in a lower rate for a long term.

thoughts on “Home Loan Rates”

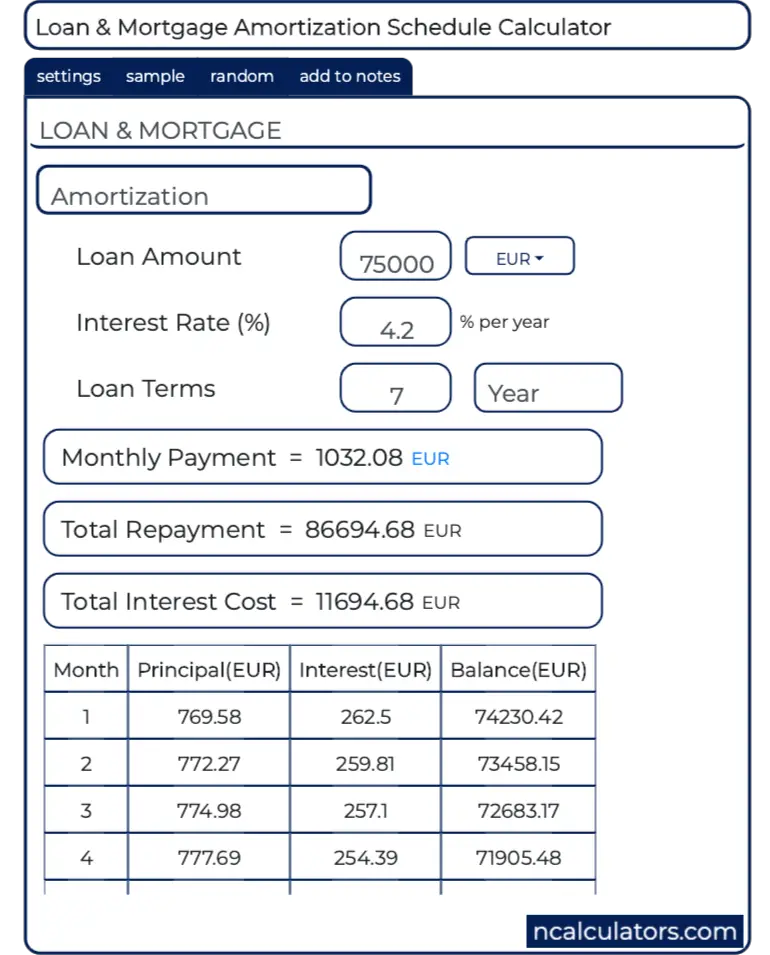

Home loans are a long-term debt, so even small differences in interest rates can make a big difference to the total amount paid on a loan over its lifetime. Home loan interest rates are at historically low levels, they can still vary considerably between products and lenders. You take out a mortgage as normal but only repay the interest portion of your debt. Hence your payments will be smaller but you are not paying off any principal. This is really only a type of mortgage to provide temporary relief if you have cash flow issues.

To simplify your financial life and pay less interest, you may be able to consolidate other borrowing into your floating rate home loan. Provided the borrower has more than twenty percent equity, most lenders will allow interest-only repayments for a period of up to five years. After that the loan reverts to principle and interest repayments over its remaining term. Here at loan interest we have sourced out some of the best home loan lenders in New Zealand with some of the best mortgage rates. Home loan rates starts from 2.28% and goes upto 5.99% depending on the loan durations.

We arrange around $1 billion of loans per year which gives us negotiating power and access to better rates. What’s going on in the market, you won’t break into a sweat every timeinterest ratesgo up or down. View terms and conditions for all our home lending products here. If you don’t pay amounts when they’re due, your loan account may exceed its limit and the rate of interest that’ll be applied to the overlimit amount will be the interest rate + 5% p.a.

An interest-only mortgage is a loan that requires you to pay the interest charged on the loan, but not the amount you have borrowed. Our expert advisers work with a wide range of lenders and often have access to lower-than-advertised rates. And if your situation is complicated, by something like overseas assets or a low deposit, you definitely want to be working with one of our top performing mortgage advisers. To get access to special offers and lower-than-advertised rates, we recommend you consult an expert mortgage adviser with a strong track record of success. Try our new ‘find a broker’ service which is free of charge, with no obligation.

Whether you want to compare or get a better mortgage rate, you pay nothing. Fix your interest rate and be sure your repayments will stay the same. However, having a 20% deposit puts you in a much stronger position when you approach a lender. If your deposit is below 20%, you’ll find that some lenders look at your application more closely or simply reject your application.

No comments:

Post a Comment